Background Information

Thai Credit Retail Bank Public Company Limited commenced its operations on January 18, 2007. It was operating within the defined parameters of retail banking stipulated by the Bank of Thailand. Subsequently, on September 1, 2023, the institution transitioned into a commercial bank and rebranded as “Thai Credit Banlk Public Company Limited.” Thai Credit Bank Transformation and Innovation was made to make the bank’s financial products and services better. The aim was to meet the various needs of all of the customers. Thai Credit Bank maintained a specific focus on offering SME business loans, Nano and Micro Finance, particularly targeting small businesses. This commitment is grounded in the bank’s overarching philosophy of “Everyone Matters, everyone is important,” reflecting its dedication to fostering financial inclusivity and contributing to the sustainable development of the economy and society (TCRB Bank, 2018).

Thai Credit Retail Bank (TCRB) has successfully transitioned into a commercial bank and the Bank of Thailand authorized this shift, effective August 17, 2023. By September 2, TCRB is set to list on the Stock Exchange of Thailand (SET) with an IPO plan. The filing indicates around 347 million shares, with proceeds intended for strengthening capital, expanding the credit portfolio, business growth, and IT and digital infrastructure development. Thai Credit Bank’s Transformation and Innovation moves align with its commitment to sound management and open avenues for foreign exchange and high-risk transactions (Banchongduang, 2023).

Financial Performance of TCRB Bank From 2018 to 2022

Over the past five years, TCRB has demonstrated a commendable financial performance, showcasing consistent growth in both net profit and equity. In 2018, the net profit amounted to 771 million THB, while the equity stood at 6.2 billion units. After five years in 2022, TCRB bank gained a remarkable net profit amounting to 2.3 million THB which is a 205% gain over the five years. Moreover, its equity has also increased up to 14 billion THB which is a 129% increase. These robust financial figures reflect TCRB’s consistent commitment to financial excellence and strategic growth, positioning the bank as a formidable player in the banking industry.

Strategy and Business Plan for 2023

In its strategy and business plan for 2023, Thai Credit Retail Bank emphasizes a growth plan for key loan services, with a focus on small and micro-business customers. The bank aims to develop products like Micro SME Loans, Micro Finance, and Home Loans while ensuring effective risk management and portfolio quality control for sustainable growth. Additionally, the bank envisions digitization as a pivotal aspect of its future, with plans to expand its mobile banking application and Micro Pay e-Wallet. These initiatives align with the cashless society concept and aim to provide customers with seamless digital experiences. Furthermore, Thai Credit Bank Transformation is committed to developing new businesses, expanding its deposit branches for fundraising, enhancing customer service systems, and venturing into wealth management services, reflecting its dedication to meeting evolving customer demands, improving lives, and contributing to Thailand’s long-term economic growth (Thai Credit Retailer Bank, 2023).

Digital Platform

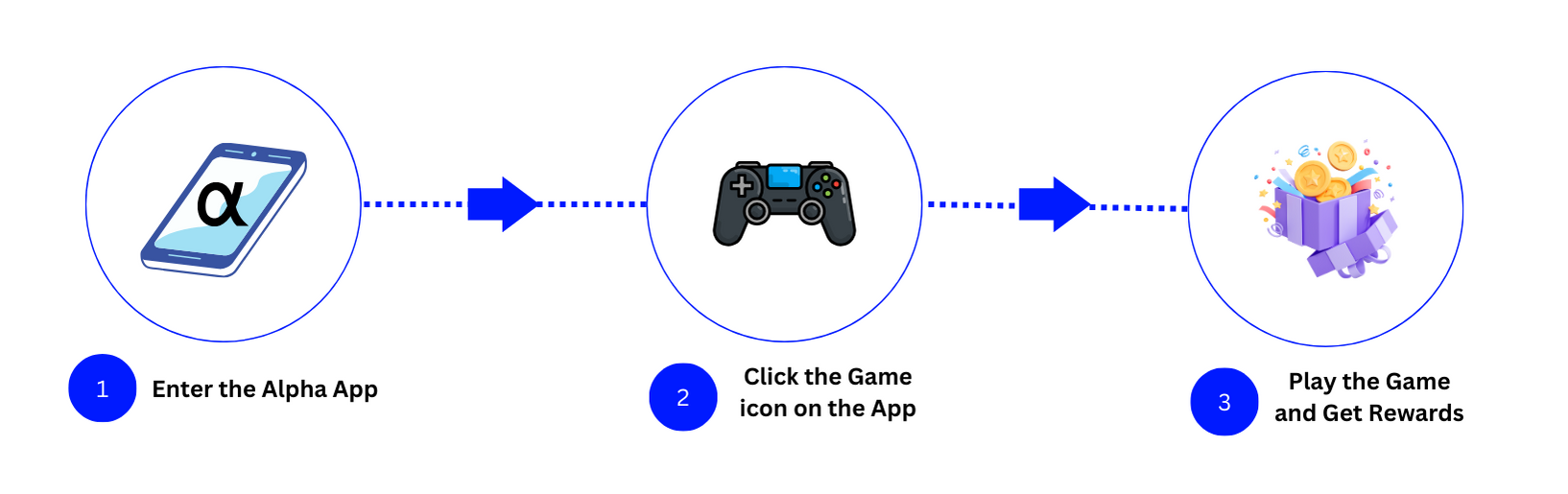

Thai Credit Retail Bank recognizes the significance of providing financial services through digital channels to stay up to date with changing consumer behaviour and government policies that strive for Thailand to become a digital society. This commitment underscores the Thai Credit Bank’s transformation and innovation in the banking sector, ensuring it remains at the forefront of technological advancements and customer-centric service delivery. Consequently, the Bank created the “Alpha by Thai Credit” mobile banking application. This facilitates and prioritizes secure financial transactions in the digital era for the bank. Thai Credit’s mobile banking service maximizes convenience for customers to easily perform financial transactions such as money transfers, bill payments, and cardless cash withdrawals at partnered banks as well as cash deposit and withdrawal options through banking agents or the counter service (Thai Credit Retailer Bank, 2023).

Look Social Co. Ltd. (LSC) played a pivotal role in the TCRB game project through collaboration with the game development team. LSC’s contributions spanned various facets, including API development, server connectivity, and system architecture. The collaborative efforts ensured the seamless integration of different components within the game. Emphasizing the critical aspect of security, LSC implemented robust measures to safeguard user data and gaming transactions, creating a secure gaming environment. Multiple testing and vulnerability assessments were conducted to identify and address potential security vulnerabilities comprehensively. This dual commitment to functionality and user experience resulted in the creation of a game. It entertains while prioritizing security, emphasizing the need for a balance between enjoyment and safety in gaming. The game will serve as a prominent feature for promotional campaigns within the “Alpha by Thai Credit” app.

Stakeholders

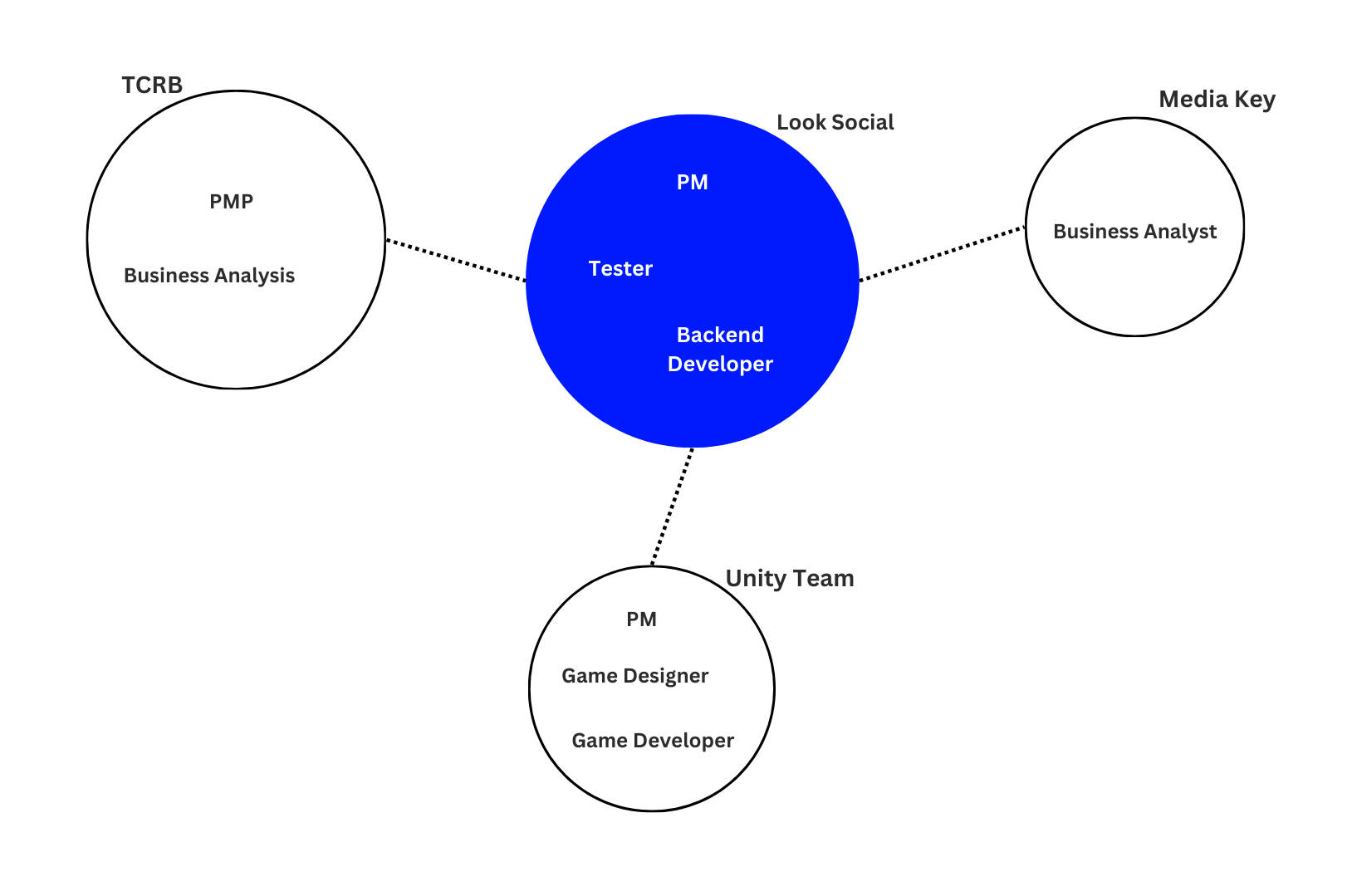

There are four stakeholders in this project which are the unity team, the Look Social team, the MediaKey and the TCRB bank. The details of stakeholders can be seen in the following diagram.

Objectives of the Project

- Improve Customer Engagement by Integrate interactive gaming to boost customer satisfaction

- Reinforce Brand Visibility which strategically using the game for promotions, creating a memorable brand experience

Approach

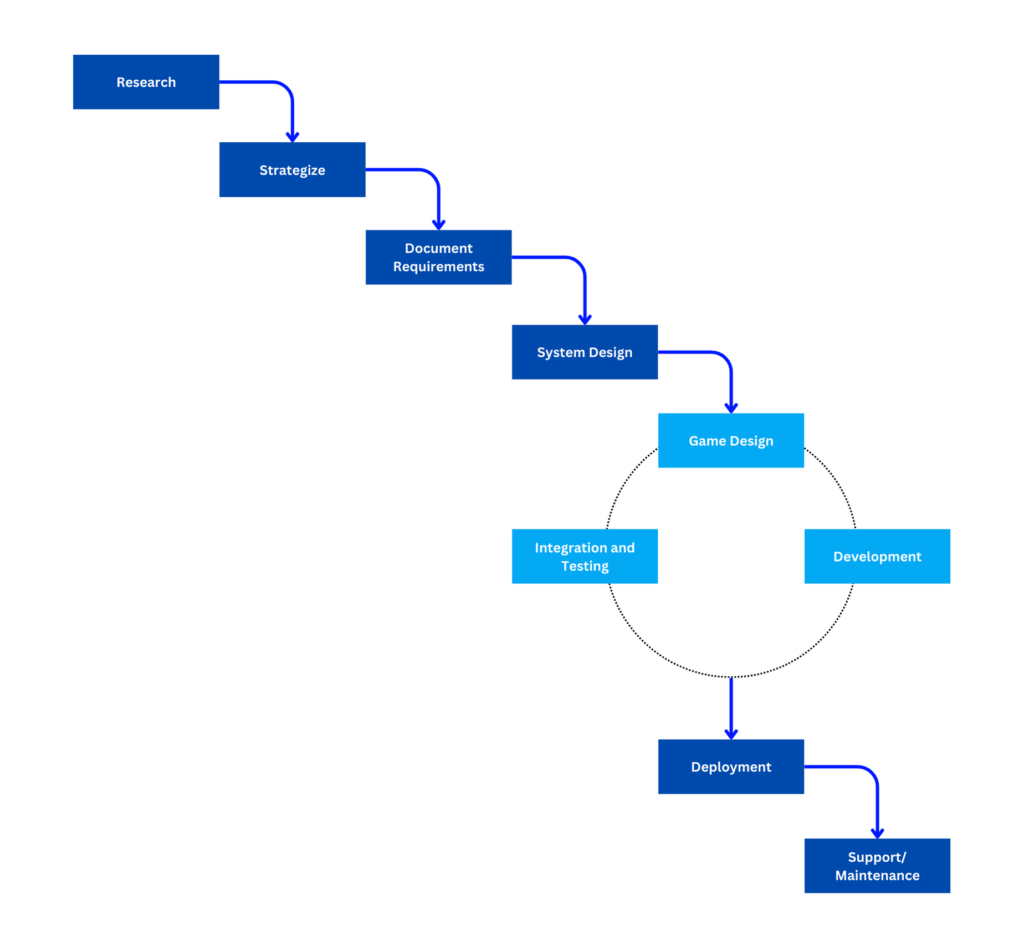

The Agile-Waterfall Hybrid Approach has been employed for the TCRB game project, seamlessly integrating the best of both methodologies. This hybrid model allows for flexibility in software development, combining the collaborative nature of Agile for software teams with the structured Waterfall approach for development teams and product managers. The chosen approach is geared towards achieving improved customer engagement through interactive gaming, reinforcing brand visibility, and ensuring a harmonious balance between functionality and user experience (Bergmann & Hamilton, 2024). The project’s collaborative stakeholders include the Unity team, Look Social team, MediaKey team, and the TCRB bank teams, highlighting the comprehensive and inclusive nature of the Agile-Waterfall Hybrid Approach in this gaming venture.

Implementation

The implementation of the TCRB game project involves the integration of various cutting-edge technologies to ensure a seamless and engaging gaming experience. The technology stack employed comprises VueJS for front-end development, providing a dynamic and responsive user interface. The back end is powered by Golang, a robust and scalable web framework, along with PostgreSQL as the database management system to efficiently manage and organize game data.

The game’s interactive and immersive elements are facilitated through the utilization of Unity, a versatile game development platform, while Blender contributes to the creation of visually appealing and dynamic graphics. The entire system operates on AWS (Amazon Web Services), ensuring reliable and scalable cloud infrastructure to support the game’s functionalities. Postman is employed for API development and testing, streamlining communication between different components of the system.

The outcome of the Projects

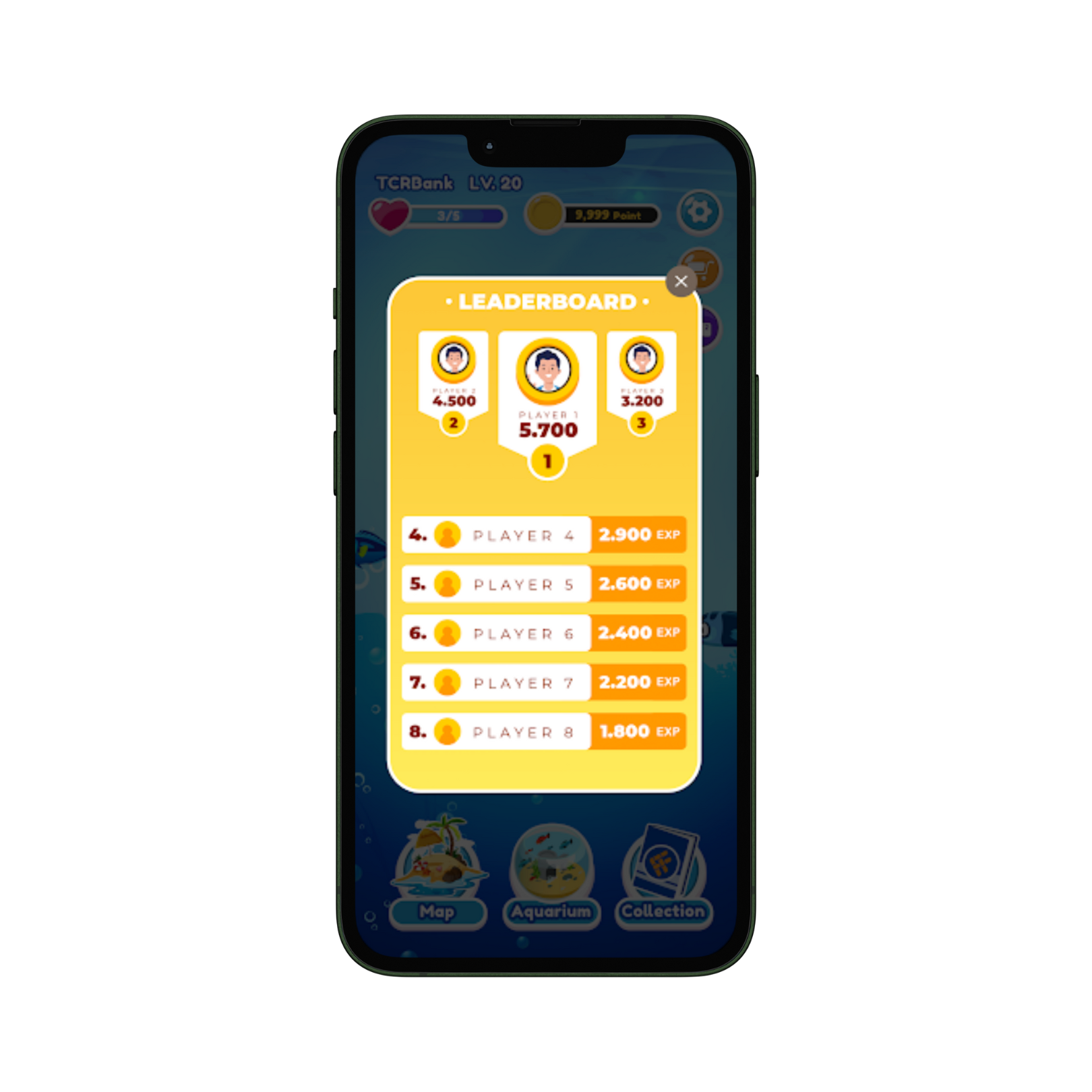

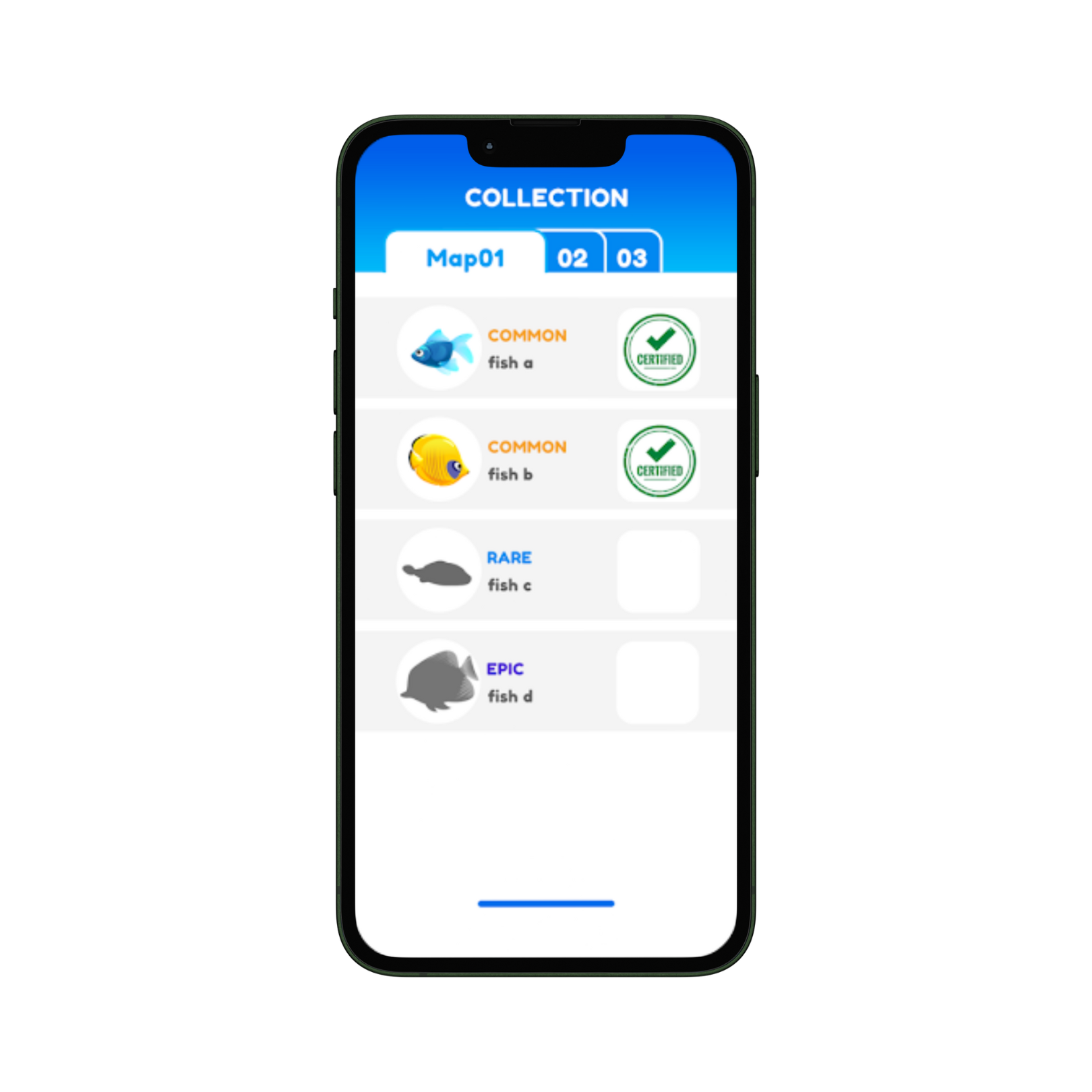

Explore the game’s visuals in the following pictures. One noteworthy aspect is the implementation of a “Saving Feature,” emphasizing sustained engagement beyond one-time play. This feature encourages multiple plays, aligning with Thai Credit Bank’s commitment to providing not just entertainment but a lasting and valuable experience for users. The game, a collaborative effort with Look Social Co. Ltd., serves as a powerful promotional tool within the app, contributing to improved customer engagement and brand visibility.

Challenges & Solutions

| Challenges | Solutions |

|---|---|

| Integration (system) Complexity: The TCRB game project involves the integration of diverse components, including API development, server connectivity, and system architecture, leading to potential challenges in ensuring seamless collaboration. | Clear Communication and Collaboration To address integration complexities, maintaining clear communication channels and fostering collaborative efforts among the stakeholders, including the Unity team, Look Social team, MediaKey team, and TCRB bank teams, is crucial. Regular meetings, status updates, and collaborative tools can facilitate effective communication, ensuring everyone is on the same page throughout the project. |

| High Security as a Top Priority: Given that the client is a bank, ensuring the highest level of security is paramount to safeguard sensitive financial data and maintain the trust of customers. | Addressing the challenge of prioritizing high security for our banking clients, our solution encompasses a comprehensive set of measures. These include the implementation of robust firewalls and encryption protocols to safeguard network traffic and data, stringent access controls through user authentication and multi-factor verification, regular backup procedures, and a resilient recovery plan to ensure data integrity. Additionally, endpoint security measures, such as antivirus software and intrusion detection, are employed to protect individual devices, while adherence to stringent cloud security practices, including data encryption and access controls, further fortifies the overall security infrastructure. By integrating these security layers, we ensure a secure environment for our client’s banking operations, instilling trust and confidence in the protection of sensitive financial information. |

Conclusion

In summary, Thai Credit Bank’s Transformation and Innovation into a commercial entity and its strategy. The robust financial performance over the past five years underscores the effectiveness of its growth strategies. The 2023 business plan further emphasizes digitalization and novel financial products, exemplified by the “Alpha by Thai Credit” mobile banking app, illustrating a dedication to providing seamless and secure digital financial services. The collaboration with Look Social Co. Ltd. for the TCRB game project showcases a forward-thinking approach, leveraging technology for customer engagement and brand promotion. The Agile-Waterfall Hybrid Approach employed in the project, coupled with the integration of cutting-edge technologies, demonstrates Thai Credit Bank’s agility and commitment to delivering a modern and immersive gaming experience. Overall, the bank’s holistic approach positions it as a prominent player, contributing to both economic development and customer-centric banking experiences in Thailand.

References

Banchongduang, S. (2023, September 1). In shift to commercial bank, Thai Credit Retail Bank sets IPO plan. Bangkok Post. Retrieved January 22, 2024, from https://shorturl.at/ksO59

Bergmann, E., & Hamilton, A. (2024). Agile-Waterfall Hybrid: Is It Right for Your Team? Lucidchart. Retrieved January 19, 2024, from http://tinyurl.com/258yebtp

TCRB Bank. (2018). Annual Report 2018. Thai Credit Bank. Retrieved January 18, 2024, from http://tinyurl.com/2s4jwzyr

TCRB Bank. (2019). Annual Report 2019. Thai Credit Bank. Retrieved January 18, 2024, from http://tinyurl.com/r8mjmtmd

TCRB Bank. (2020, February 28). Annual Report 2018. Thai Credit Bank. Retrieved January 18, 2024, from https://shorturl.at/kqwL4

TCRB Bank. (2021). Annual Report 2021. Thai Credit Bank. Retrieved January 18, 2024, from https://shorturl.at/fwIJX

TCRB Bank. (2022). Annual Report 2022. Thai Credit Bank. Retrieved January 18, 2024, from https://shorturl.at/ekmIU

TCRB Bank. (2023). Annual Report 2023. Thai Credit Bank. Retrieved January 18, 2024, from https://shorturl.at/bejUY

Thai Credit Retailer Bank. (2023). Annual Report 2022. Thai Credit Bank. Retrieved January 18, 2024, from https://shorturl.at/jnsAF

Turn Your Ideas into Digital Reality with Us

Contact us to transform your ideas into tailored digital solutions. We’ll work collaboratively to find and implement the solutions your company needs for growth. Join us in the digital journey, and let’s walk together towards success.

Aung Hein Htet

Solution Designer in Business Development Team